Hello and welcome to the Money News Roundup newsletter. Today we’re covering President Ruto’s contradiction of CS Mbadi’s stance on education funding, as well as concerns about schools facing closure over capitation cuts.

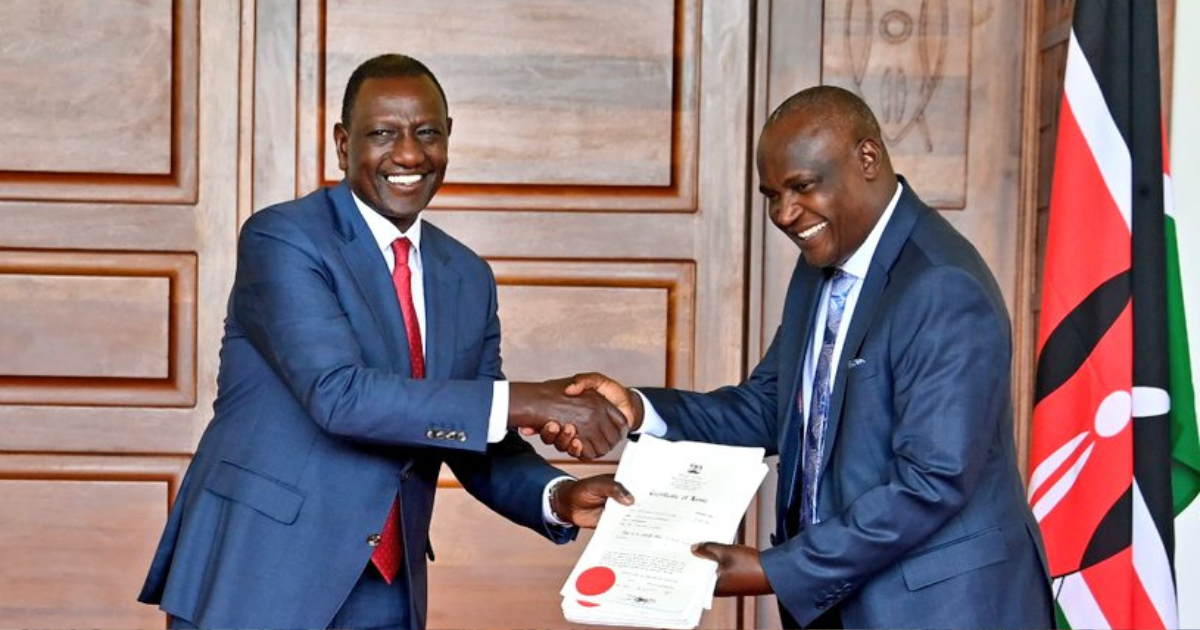

Ruto, Treasury CS Reading From Different Scripts

President William Ruto on Sunday assured Kenyans that the government will continue funding primary and secondary education as per the existing model, seemingly contradicting an earlier statement by Treasury CS John Mbadi.

Addressing a congregation, the Head of State emphasized that free primary and secondary education is a constitutional right for all Kenyans.

“I want to assure you that free primary and secondary education is a constitutional right of every Kenyan. In the last two years, we have launched several initiatives to ensure that education is truly universal and accessible,” he stated.

“Our commitment is based on the belief that education is the greatest form of empowerment a society can give its young people. That’s why it must be affordable, accessible, high-quality, and relevant.”

His Justification: The president explained that to enhance access to education, the government has built 23,000 classrooms over the past two years and increased funding for university students.

Catch Up Quick: Last week, while appearing before a National Assembly committee, CS Mbadi noted that the student population in primary and secondary schools had ballooned, making it difficult for the government to maintain the current capitation of Ksh22,244 per student. He hinted that the amount might be reduced to Ksh16,900.

However, over the weekend, he claimed he was misquoted. Clarifying his statement, Mbadi said, “I was speaking to policymakers—members of Parliament who approve the budget. I told them we must enhance the capitation budget so that every child receives Ksh22,000. What we currently have in the budget is less than that.” Read more on Citizen TV.

Schools Facing Closure Over Delayed Capitation

The Kenya Secondary School Heads Association (KESSHA) has warned that hundreds of schools are on the verge of being auctioned due to chronic delays in the release of government capitation funds.

Former KESSHA chair Kai Indimuli revealed that schools have been accumulating debt since 2019, forcing many to rely on donations. Several schools have already shut down early due to a lack of resources such as food.

“Just before I left office, we met with other association heads and petitioned Parliament, highlighting that since 2019, schools have been receiving less capitation. At the time of the petition, schools were owed Ksh68 billion,” Indimuli said, as per Kenyans.co.ke.

CBK Proposes Priority Bond Access for Banks in New OTC Market

The Central Bank of Kenya (CBK) is proposing a new over-the-counter (OTC) bond trading system that would give commercial banks and market makers priority in purchasing Treasury bonds. As reported by Business Daily, this system would operate separately from the current auction model, with banks playing a lead role in setting prices and buying large volumes of government securities directly.

While the OTC market will still allow participation from other investors, commercial banks would effectively act as wholesalers — buying in bulk and reselling to others. The CBK expects this move to revitalise trading in government paper and potentially reduce returns, as the system shifts toward more flexible, market-driven pricing.

KRA to Upgrade Customs System with AI in Modernisation Drive

The Kenya Revenue Authority (KRA) has announced plans to upgrade its Integrated Customs Management System (iCMS) in the 2025/2026 financial year as part of a broader push to modernise cargo operations. According to Eastleigh Voice, KRA Commissioner General Humphrey Wattanga said the phased overhaul will incorporate artificial intelligence to streamline processes, reduce delays, and improve efficiency in customs handling.

Speaking during the launch of the Kenya International Freight and Warehousing Association’s (KIFWA) 2025–2030 strategic plan, Wattanga noted that the future of customs lies in smart, data-driven systems. The iCMS, introduced in 2021, has already reduced clearance times by over 60% by enabling electronic document submission and regional system integration. KRA is now piloting AI, machine learning, and data analytics to enhance tax operations and detect fraud.

Nema Blocks Sh155M Solar Project Tied to Deported Turkish Investor

Kenya’s environment watchdog has rejected a proposal to build a 50-megawatt solar power plant in Laikipia County, citing gaps in cost disclosure and lack of public participation. According to Business Daily, the National Environment Management Authority (Nema) said the Sh155.4 million Umoja Solar Power Plant failed to meet critical legal requirements, including a breakdown of construction costs. Analysts also flagged the budget as unusually low, amounting to less than 3% of the typical cost for projects of similar scale.

The project was fronted by Ümit 2HA Investment Energy Africa, a firm linked to Harun Aydin, a controversial Turkish businessman deported from Kenya in 2021. Aydin is listed as a shareholder and director of the company, which had already acquired a 3,000-acre plot for the plant. Nema chief executive Mamo Boru Mamo noted the application was dismissed after the firm failed to provide a detailed and itemised budget.

Counties Under Fire for Unmonitored Bank Accounts

The Central Bank of Kenya (CBK) has admitted it cannot fully track the hundreds of bank accounts opened by county governments, raising concerns over a lack of transparency and potential misuse of public funds. According to Eastleigh Voice, CBK Governor Kamau Thugge told senators that commercial bank accounts operated by counties are largely unmonitored unless flagged by oversight agencies, creating a loophole for financial mismanagement and corruption.

Thugge explained that many of the 47 counties continue to use commercial bank accounts due to the absence of a clear legal framework, with some reportedly opening multiple accounts for health and education services. Although efforts to introduce a single treasury account have been ongoing for over two decades, implementation has been slow. Thugge said CBK is working toward consolidating accounts to reduce misuse and improve financial accountability.

Kenya's Vehicle Market Rebounds with Strong Half-Year Sales

New vehicle sales in Kenya saw a significant 25.05% increase in the first half of the year, driven by stable shilling and inflation rates, marking the highest growth in three years, Business Daily reports. Isuzu East Africa led this surge, strengthening its market leadership with a 48.35% share, while CFAO Kenya (formerly Toyota Kenya) and Simba Corp also reported sales increases. Overall, the market sold 6,360 units compared to 5,086 units in the same period last year, with Isuzu alone selling 3,075 units, a 26.13% jump.

Despite the positive growth, new motor vehicle dealers faced challenges from a tough operating environment since 2022, including a weakening US dollar, a shortage of foreign exchange, and the high cost of living. However, companies expressed optimism in mid-April due to the stable forex and inflation rates. The industry also experienced its highest growth rate in new vehicle showroom purchases in the past four years, with sales jumping 34.96% to 6,246 units in the first half of 2021.

Join 1.5M Kenyans using Money254 to find better loans, savings accounts, and money tips today.

Money 254 is a new platform focused on helping you make more out of the money you have. We've created a simple, fast and secure way to find and compare financial products that best match your needs. All of the information shown is from products available at established financial institutions that our team of experts has tirelessly collected.